Publication date: 12 May 2021

Since the regulation around the world introduced new laws which have come into force, the cryptocurrency has every chance to become an integral part of everyday life. Both large companies and major investment banks are showing interest in digital assets. The market capitalization of all existing cryptocurrencies as of 2021 exceeded 2 trillion dollars! Let’s look at what is happening on the market of this global financial system.

Which country is the most favorable environment for the crypto?

According to the Association of Forex Dealers (AFD), Russia lags 10 years behind the United States in regulation of bitcoin. This is due, among other things, to the fact that the Russian authorities do not have a common attitude to regulation of this area. As a result, the financial market consists of entities of fundamentally different formats, most of which do not have a license from the central bank.

According to experts, the Russian Federal Law “On Digital Financial Assets” is the basic one. To make it really work, it is necessary to adopt a number of bylaws whereas, total ban imposed on the circulation of digital currencies will not lead to anything whatsoever.

Cryptocurrency in Russia: interesting facts

- In Russia, access to investing in cryptocurrency may become easier, but only for wealthy clients. Russian banks are eager to offer users private banking services such as tools for buying BTC, ETH, USDT and GUSD for fiat funds — euros and dollars. Aximetria, a service licensed by the Swiss regulator, has become the project partner. The entry fee limit for the client is $ 100,000.

- The youngest billionaire in the world of cryptocurrencies is the co-founder of Ethereum, 27-year-old Vitalik Buterin, who was born in Kolomna. In 2014, the young man received an award from the famous venture investor Peter Thiel. The money allowed him to launch his own blockchain platform, Ethereum. Buterin earned $1.09 billion when the price of the token first reached three thousand dollars per item, says Forbes.

It is worth noting that advanced authorities do not prohibit bitcoin, but control it. Any facts of fraud trigger immediate response. For example, the Belarusian cryptocurrency market is one of the most favorable at the moment as it was launched nearly latest, the authorities took into account the mistakes of all neighboring jurisdictions and wisely avoided them, the expert believes. In Ukraine, several major crypto exchanges have suspended the service to restrict local citizens. Perhaps this will force the country’s authorities to pay attention to the regulation of this industry, the Ukrainian regulatory framework will be adapted to the needs of companies, and the market will carry on working.

Cryptocurrency world news

- Libra changed its name to Diem in order to emphasize the gap between the company and Facebook. Its first launch may take place as early as January 2021. The project will be set up in a much more moderate form. Currently, the non-profit organization behind the project, the Diem Association, is negotiating with the Swiss financial regulator to obtain a license for transactions to promote the issue of digital currency.

- The Venom service, owned by PayPal, allows customers to buy, store, and sell Bitcoin, Ethereum, Litecoin, and Bitcoin Cash in mobile apps. The minimum transaction amount is $1. The application lets you trace the progress and calculate profitability of the cryptocurrencies.

Why ban cryptocurrency?

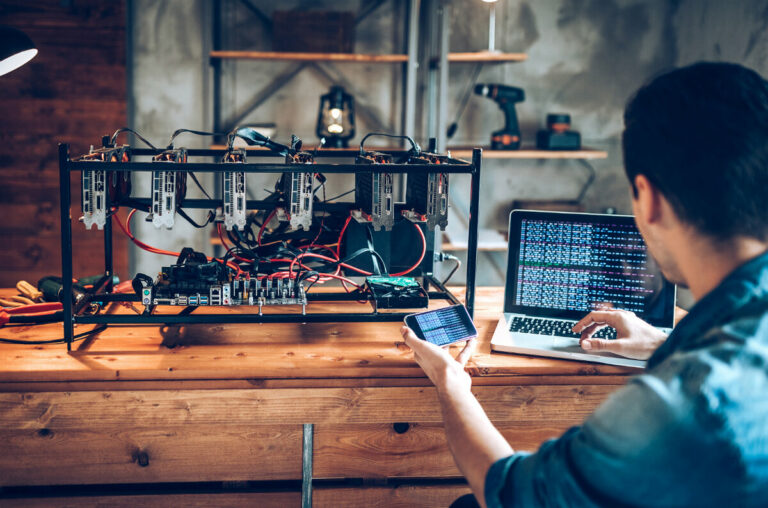

The chairman of the New York State Senate Committee on Energy and Telecommunications has introduced a bill that proposes to impose a moratorium on mining cryptocurrencies using electricity produced by burning fossil fuels in the state for a period of three years. The senator advocates cryptocurrencies mining ban as it will reduce the negative impact on the environment. In February 2021, the bitcoin network consumed as much energy as Argentina, with a population of 44 million. By 2024, if this continues, the cryptocurrency market in China alone will consume as much energy as Italy in a year. The volume of carbon dioxide (CO2) emissions will be equal to those produced by the Czech Republic within one year. This data was published by the University of Cambridge in its case study. These studies show that the most active mining of the first crypto occurs in China. The region mines 65% of the world’s capacity amid North American miners, who create only 8% of the global hash rate. The next in the league table are Russia, Kazakhstan, Malaysia and Iran.

- In Russia, from April 1 to April 15, the minimum miner`s kit cost more than 78,000 rubles, which is a 69% higher price than that in April 2020. Analysts also state that a number of products and services which had the word mining in the name and were sold increased seven times.

Such figures in China may be explained there are several objective reasons. Firstly, the Chinese government often subsidizes the miners. Secondly, they have access to discounted computer chips buying directly from the world’s largest manufacturers. Thirdly, the electricity in some of the most important mining provinces, such as Xinjiang, is very cheap, at least five times cheaper than standard tariffs. Most of the energy comes from coal. But as CoinShares estimates, 73% of miners use at least some of the renewable energy. It also includes the hydropower of China’s massive dams. But in general, most of the energy still comes from dirty sources.

Share it with your friends via favorite social media