Last Updated: 5 december 2025

Argentina boasts a deep-rooted gambling history, blending European traditions with local nuances. Although online casinos and betting aren’t as developed as in Brazil, they still attract enthusiastic gamblers. Our new 3S.INFO overview offers a comprehensive guide to Argentina’s iGaming market for affiliates and operators. Learn about key trends, legal framework, major players, popular products, and payment solutions.

This content serves informational purposes only. We do not endorse violations of local laws or service policies. Please familiarize yourself with local regulations and comply accordingly!

Why Direct Traffic to Argentinian Betting and Gambling?

Argentina isn’t just a vast country. Moreover, it’s one of the most digitally advanced markets in Latin America. Almost 90% of the population uses the internet, smartphones are ubiquitous, even among older generations (50+). The pandemic accelerated online gambling. Those who previously placed bets at land-based points transitioned online. Besides, local operators, recognizing the trend, began competing with global brands, tailoring their offerings to Argentinian tastes.

The main trends in iGaming currently include online sports betting (especially football, tennis, basketball), online casinos, poker, and even lotteries. Everything has shifted to mobile, and payment solutions are becoming increasingly convenient. Argentinian audiences crave fast payouts, fair bonuses, and top-notch service. Additionally, there is a high tolerance for cryptocurrency payments due to economic conditions and inflation. Many users prefer paying via crypto wallets or p2p services.

All these factors make the market even more attractive for monetizing betting and gambling traffic.

History and Interesting Facts About the Gambling Development in Argentina

Argentina is one of the few Latin American countries where gambling has never been historically prohibited. Casinos and lotteries appeared here as early as the 19th century and remain integral parts of the cultural fabric. Offline casinos are present in virtually every major city, while racetracks and sweepstakes constitute a distinct form of national sport.

The earliest games were brought by Spanish colonizers in the 16th century, including card games like Monte and poker. Lotteries and horse racing gained prominence in the 19th century, particularly among aristocrats. Meanwhile, the first casino opened in the late 1880s in the seaside town of Mar del Plata.

In 1946, President Juan Perón tightened control over gambling, leading to the closure of many clandestine establishments. Later, in 1976, the military junta sought to attract tourists by authorizing casinos in provincial areas.

A critical turning point occurred in 1999 when the Supreme Court ruled that activities such as lotteries, casinos, bingo, and slot machines did not fall under federal jurisdiction. Subsequently, the federal government retained responsibility solely for combating crime, delegating all powers of regulation, licensing, and monitoring of the gambling industry to provincial governments.

The online gambling market began to take shape around 2012–2015 when provinces started legalizing online gambling. During the pandemic, the online sector became a lifeline for those unable to access offline venues. Over the past 3–4 years, the market has seen explosive growth, with demand for online casinos and betting increasing by at least 20% annually.

Today, Argentina remains one of the most liberal countries in Latin America regarding gambling, although regulations vary widely across provinces.

Gambling Regulation in Argentina

Argentina’s administrative structure consists of 23 provinces and the federal capital district of Buenos Aires. Each province has its own set of laws and autonomy to independently regulate betting and gambling.

Land-based casinos are legal in ten provinces: Buenos Aires (home to Casino Trilenium, the largest casino in Latin America), Mendoza, Salta, Córdoba, Chaco, Entre Ríos, Santa Fe, Neuquén, Río Negro, Iguazú.

Where in Argentina Are Online Betting and Casinos Allowed?

- Since 2022, iGaming has been fully legalized in Buenos Aires, regulated by Loteria de la Ciudad (City Lottery Regulator). Over 30 operators have received licenses, including: Codere Online, Betsson, William Hill, Playtech, Bet365, Dafabet, Bplay (local operator), PokerStars, GG Poker. Tax rate: 2% of turnover. According to experts, the city has over 0.5 million active players, with online gambling revenue exceeding $200 million annually.

- Online gambling has been fully legalized in the province of Buenos Aires since 2020 (Law No. 15244). License cost: approximately $500,000. Regulation is handled by Instituto Loteria y Casinos (IPLyC), and licenses can be checked on their website under “Operadores Habilitados.” More than 25 operators have obtained licenses, including: Casino Trilenium Online, Betsson, Playtech, Boldt, BetWarrior. Online casinos pay 12% tax on GGR, while bookmakers pay 10%. The province has 1.8 million registered players, with an annual turnover of around $1.2 billion.

- In Córdoba, online gambling is fully legalized and regulated by local authorities. Licenses are granted by IPLyC (Lottery and Casino Institute of Córdoba). Licensed betting operators include: Сoolbet, Betsson, Bplay, LocalBet. For online casinos, licenses are held by Casino de Córdoba Online and several international operators.

- Entre Ríos has legalized online betting since 2021, with online casinos regulated by local authorities. The regulatory body is Lotería de Entre Ríos (LoterER), which has issued 12 licenses to online operators.

- Santa Fe allows online betting and casinos. The regulatory authority is Lotería de Santa Fe, which issued licenses to 14 operators in 2024.

- Mendoza Province allows all forms of online gambling. The regulatory authority is Lotería Mendoza, which issued eight licenses in 2024.

- Rio Negro and Neuquén provinces allow only online sports betting.

Where in Argentina Is Online Gambling and Betting Definitely Prohibited?

- San Luis: The only province with a complete ban on all forms of gambling.

- Formosa: Online gambling is blocked at the ISP level.

- Santiago del Estero: No regulation exists for online gambling, but banks block transactions to betting companies.

In the remaining provinces, online gambling and betting are not specifically regulated. There are no separate laws clarifying the status of online casinos and betting companies in these regions. Their laws do not prohibit the operation of international gambling platforms.

How to Obtain a Gambling License in Argentina?

To obtain a gambling license for casinos and betting in Argentina, companies must be locally incorporated with a legal entity and bank account in Argentina. In many provinces, partnerships with local companies are mandatory (entering under a local franchise).

iGaming licenses in Argentina cover online casinos, sports betting, esports, lotteries, virtual, and live games. Licenses are usually valid for 5 years, renewable. Cost depends on the province, averaging from $100,000 to $600,000 (one-time payment plus an annual fee of up to 5% of GGR).

Main Requirements for Obtaining a Gambling License in Argentina:

- Authorized capital: at least $1 million equivalent.

- Transparent ownership structure.

- RNG and Responsible Gambling certifications.

- Local hosting (often a mandatory requirement).

The Argentinian betting and online casino market, despite its appeal, is a complex jurisdiction with a decentralized regulatory model. The licensing process involves significant time and financial investments and requires a deep dive into the specific legislation of each individual province. All the details, step-by-step instructions, and descriptions can be found in the guide “What is a Gambling License in Argentina?”.

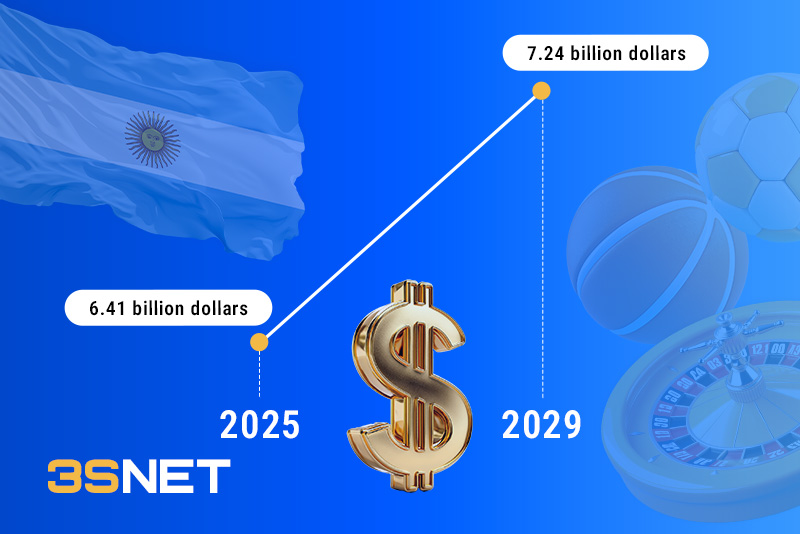

Revenue in Argentina’s Gambling Market

According to Statista (April 2025), Argentina’s gambling market revenue in 2025 is estimated to reach $6.41 billion. By 2029, revenue growth is projected at 3.11%, leading to a market size of $7.24 billion. Meanwhile, the number of users in betting and gambling will reach 11.7 million individuals.

Which Casino and Betting Brands Operate in Argentina?

The Argentine iGaming market is split evenly between local and international giants.

According to Blask’s analysis (June 2025), the top 10 most popular gambling brands in Argentina include:

- Bet365;

- Betsson;

- BetWarrior;

- Bplay;

- Betano;

- Casino Magic Online;

- City Center Online;

- Stake;

- 1xBet;

- Palpitos.

Large Local Online Casino and Betting Operators in Argentina and Their Significance for Affiliates

Local companies often collaborate with international brands.

It’s crucial for affiliates to understand local operators because they offer unique promotions and exclusive bonuses tailored to local traffic. Unlike larger international platforms, local operators provide greater flexibility in marketing creatives, enabling campaigns linked to local events such as football derbies or national holidays. This increases audience engagement since local brands are more recognizable, and familiar payment methods enhance conversion rates. Additionally, partnership terms with local operators tend to be more advantageous, with fewer stringent limits on payouts typical of global companies.

However, local iGaming operators have both strengths and weaknesses. On the positive side, they offer excellent localization, prompt support, and exclusive offers tailored specifically for the local audience. Conversely, their product portfolio may be limited, and scaling up can be difficult due to reliance on offline infrastructure and outdated technologies. Nevertheless, for affiliates focusing on narrow audiences, local operators can be a profitable alternative to international giants.

Bplay (BOLDT Group): One of Argentina’s most prominent online brands, operating in multiple provinces (Buenos Aires, Santa Fe, Cordoba, etc.). Offers unique promos tailored to each province, strong mobile version, and cross-promotion with local lotteries and offline casinos. Long-standing market presence, close cooperation with local payment processors, and proprietary lottery offerings.

Jugadon (Grupo Slots): Dominant player in Mendoza, also present in other provinces. Strong focus on local slots, sports betting, and exclusive promotions. Possesses offline casinos and betting outlets, enabling hybrid promotional campaigns to attract players from offline to online.

Casino Magic (Neuquén): Leading brand in southern Argentina, specializing in online casinos, roulette, slots, and local card games. Often launches limited-time bonuses and provincial tournaments. Platform is fully in Spanish, supports fast local payment gateways.

City Center Online (Rosario): Online iteration of Rosario’s famous offline casino, one of Argentina’s largest. Emphasizes live games, tournaments, jackpots, and sports betting. Audience mainly from Central Argentina, where the offline brand is well-known.

BetWarrior (Intralot + local investors): Though originally an international brand, the Argentine version is heavily localized: dedicated team, promotional partnerships with local clubs, support for Argentine payment methods and advertising channels.

Lotería de la Provincia и Lotería de la Ciudad: Not just operators but state-run institutions managing online lotteries, scratch games and betting. In some provinces, lottery portals function as full-fledged gambling operators with a wide range of products.

Palpitos24: Strong presence in northern provinces, focuses on local sports and custom-designed slots. Actively collaborates with local influencers and organizes special promotions for social media.

How are Illegal Casino and Betting Websites Blocked in Argentina?

Illegal gambling websites are blocked at the provincial level. Authorities enforce strict measures:

- Domain blocking through local telecommunication providers.

- Payment blocking via banks and fintech services.

- Sanctions against partners and advertisers.

- Providers are mandated to filter traffic at the DNS level.

- Fines of up to $250,000 for advertising illegal platforms.

For instance, in June 2025, the regulator of Corrientes province (Lotería Correntina) reported an increase in offshore platforms and filed a police complaint. Ultimately, 424 websites actively offering sports betting and casino services were identified. Following a court ruling, access to these sites will be blocked nationwide.

Advertising Rules for Betting and Gambling in Argentina

In November 2025, Argentina, for the first time in its history, approved unified nationwide rules for online gambling advertising. The corresponding Resolution No. 446/2025, published by the Ministry of Economy, comes into force on December 3, 2025, and establishes strict requirements regarding the format, content, and accountability of advertisers.

According to the new rules, all advertisements must mandatorily contain the warning “Compulsive gambling is harmful to health” and an “+18” label. These warnings must be permanently visible throughout the entire advertisement and occupy at least 10% of the screen height. The text must be placed in a bold, contrasting font across the entire width of the lower part of the advertising space.

Special requirements concern influencer marketing: bloggers are required to keep the warning on screen for the entire duration of the promotional integration. In radio broadcasts, the warning must be read at the end of the advertisement without any musical background. Violations of the resolution’s provisions will be prosecuted under the Consumer Protection Law and regulations on commercial loyalty.

The new document cancels the previous version of the rules and establishes the country’s first federal standard for iGaming advertising. This unifies requirements for all provinces and creates an official mechanism for filing complaints about misleading advertising.

Until now, the regulation of gambling advertising in Argentina was carried out at the regional level, which created legal discrepancies and complications for operators. The new system makes the rules uniform and clearly prioritizes social responsibility. At the same time, it is important to note that the overall regulation of iGaming at the federal level remains a subject of debate and varies from province to province.

How Do Online Casinos and Bookmakers Attract Players in Argentina?

Argentina is located in South America, with a population of approximately 46 million, making it the third-largest country in Latin America after Brazil and Colombia.

Its modern population is largely composed of descendants of European immigrants, making it one of the most “Europeanized” countries in the region.

Major cities: Capital Buenos Aires (around 3 million inhabitants), university hub Córdoba (1.5 million), major port and industrial node Rosario (1.3 million), heart of wine region Mendoza (1.1 million), San Miguel de Tucumán (830 thousand), planned “ideal city” La Plata (800 thousand).

Primary language: Spanish (Argentine dialect).

Official currency: Argentine peso (ARS), though due to high inflation, dollars or cryptocurrency are frequently used.

Who Gambles in Argentina?

According to Blask’s analysis (June 2025), the profile of regular visitors to casino and betting websites looks as follows:

- Age: 25–34 years (35%), 18–24 years (30%), 35–44 years (20%), 44–54 years (10%).

- Education: Completed school/university (30% each), vocational education (25%), graduate students (10%), completed secondary school (5%).

- Occupation: Salaried employees (45%), students/freelancers (15% each), unemployed/job-seekers (10%).

- Industry: Sales (15%), finance/insurance, manufacturing/construction, marketing/hospitality/restaurants (10% each).

Why Do Argentinians Bet on Sports?

- Making money: 50%

- Combating boredom: 40%

- Enjoyment of the process: 35%

- Adrenaline rush: 30%

- Hobby: 25%

- Social activity with family/friends: 20%

- Entertainment with anonymity: 20%

- Escape from routine: 15%

Why Do Argentinians Play Casino Games?

What Types of Gambling and Betting Are Most Popular in Argentina?

- Traditional Sport Betting (football, basketball): 70%

- Lottery: 40%

- Live Casino: 35%

- Slots and Instant Win Games: 30%

- Poker/Rummy: 25%

- Esports Betting (CS, Dota 2, LoL, etc.): 20%

- Virtual Sports Betting: 15%

What Sports Are Popular in Argentina?

- Sport is deeply ingrained in Argentine culture, with several disciplines enjoying particular popularity. Below are the main sports loved and excelled in by Argentinians:

- Football: A national obsession bordering on religion. Clubs like Boca Juniors and River Plate rivalry in the heated “superclásico” derby. Betano sponsors the Professional Football League.

- Rugby: Second most popular sport in Argentina. The national team, “Los Pumas,” competes regularly in the Rugby World Cup.

- Cycling: Well-developed due to plains and mountain tracks. Tour de San Luis is a major cycling event.

- Tennis Courts: Present even in small towns. Buenos Aires hosts the ATP-250 tournament and Davis Cup (won in 2016).

- Argentina is a global leader in polo. Despite being an elite sport, the national team has won the World Championship 10 times.

- Pato is Argentina’s national sport, blending elements of basketball and play polo. Officially recognized in 1953, the game originated in the 17th century. Eight riders participate, aiming to throw a large ball into a net. Originally, a live duck was used instead of a ball, placed in a basket, hence the name “pato” derived from the Spanish word “pato” meaning “duck.”

- Continuing the topic: Betting and Gambling Traffic in Argentina: Advantages, Case Studies, Tips. All in one place!

- Do you already know everything and want to direct traffic? Read our article Best Betting and Gambling Offers in Argentina.

Popular Payment Methods in Argentina

In May 2025, the Argentine government issued Decree 353/2025 to simplify state control over financial processes.

Now, payment systems are no longer required to request personal data from customers when using credit or debit cards for deposits, nor transmit this data to regulators.

Now, providing data is only required:

- For bank transactions above $50,000 (previously $1,000).

- For e-wallet transactions above $50,000 (previously $2,000).

- When withdrawing amounts over $10,000 from ATMs (previously required for any withdrawal).

Popular Payment Methods for Deposits on Casino and Betting Websites in Argentina

- MercadoPago: Locally referred to as the “PayPal” of Argentina, it facilitates almost all online payments, from marketplace purchases to casino and betting transactions. Essential for operators: without MercadoPago, CR drop drastically.

- Bank Cards: Classically used, but with caveats. Due to currency restrictions, only local cards (Visa, Mastercard, Maestro, Cabal, Naranja) are typically accepted. Banks often block transactions deemed “gaming”-related, limiting international or unauthorized operators.

- Electronic Wallets: Ualá, Nubi, Prex, Lemon Cash, etc., are rapidly growing, especially among younger users and crypto enthusiasts. These enable anonymous funding and withdrawals, bypassing traditional banking.

- Cryptocurrency: Due to inflation, Argentinians love stablecoins like USDT, Bitcoin, etc. Operators increasingly accept deposits and payouts in crypto, particularly through P2P and OTC services (Binance P2P, Lemon Cash, Ripio).

- Peer-to-Peer Exchanges: Players collectively fund a trusted intermediary (“cashier”), usually a reliable individual or small agent, who deposits funds onto platforms using their card or crypto, then redistributes winnings back.

- Major Banks: (Galicia, Santander, BBVA) aim to distance themselves from gambling, occasionally blocking transfers. Meanwhile, fintech apps (MercadoPago, Ualá, Prex, etc.) are more accommodating, allowing even grey traffic.

The Argentine online gambling and betting market is experiencing significant growth, driven by consumer preferences for convenience and diverse betting options. Macroeconomic factors, such as economic instability, also contribute to the expansion of Argentina’s gambling market. We’ve gathered all essential information about the region and its regulations. Now it’s your turn! Choose the best betting and gambling offers in Argentina, get connected, and start generating profits!

FAQ

Why is Argentina a promising market for betting and gambling?

Argentina is one of the most “digital” markets in Latin America: almost the entire population uses the internet, smartphones are widespread even among older demographics, and players have actively moved from offline to online since the pandemic. The market is experiencing growing demand for online betting (football, tennis, basketball), online casinos, poker, and lotteries. Users value fast payouts, fair bonuses, and readily use cryptocurrencies and P2P services due to inflation and currency restrictions.

How is gambling regulated in Argentina and how do provincial approaches differ?

Argentina consists of 23 provinces and the autonomous federal district of Buenos Aires. Since 1999, the regulation of gambling has been entirely delegated to the provincial level. This means each province independently decides whether to permit online betting and casinos, what licenses to issue, and how to collect taxes. Consequently, the status of iGaming can vary significantly between Buenos Aires, Córdoba, Mendoza, or the northern regions.

Where are online casinos and betting legal, and where are they banned?

Fully legalized and regulated online gambling exists in the City of Buenos Aires, the Province of Buenos Aires, Córdoba, Entre Ríos, Santa Fe, and Mendoza. In Río Negro and Neuquén, only online sports betting is permitted. San Luis has completely banned all forms of gambling. In Formosa, online gambling is blocked by internet providers. In Santiago del Estero, banks restrict payments for it. In a number of other provinces, the online market is formally unregulated, which leaves room for international platforms to operate.

What are the requirements and approximate conditions for obtaining a local iGaming license?

Only companies with an Argentine legal entity and a bank account in a local bank can obtain licenses, often in partnership with local operators. Permits are issued for online casinos, sports and esports betting, lotteries, and virtual and live games. Licenses are typically valid for 5 years and are renewable. The approximate cost ranges from $100,000 to $600,000, plus annual fees of up to 5% of GGR. Requirements also include share capital of at least $1 million, a transparent ownership structure, certified RNG, responsible gambling measures, and often local hosting.

Which payment methods and advertising rules are important for operating in Argentina?

Key payment tools include the local fintech solution MercadoPago (effectively the “PayPal of Argentina”), national cards (Visa, Mastercard, Maestro, Cabal, Naranja), e-wallets (Ualá, Nubi, Prex, Lemon Cash), cryptocurrencies (USDT, Bitcoin), and P2P models, which help circumvent banking restrictions and inflationary risks. In 2025, a national standard for online gambling advertising was introduced (Resolution 446/2025): all advertisements must feature prominent warnings about the harm of compulsive gambling and an “+18” label, including influencer campaigns. Serious sanctions and blocks at the domain, payment, and provider levels are stipulated for violations.

Share it with your friends via favorite social media