Publication date: 23 March 2025

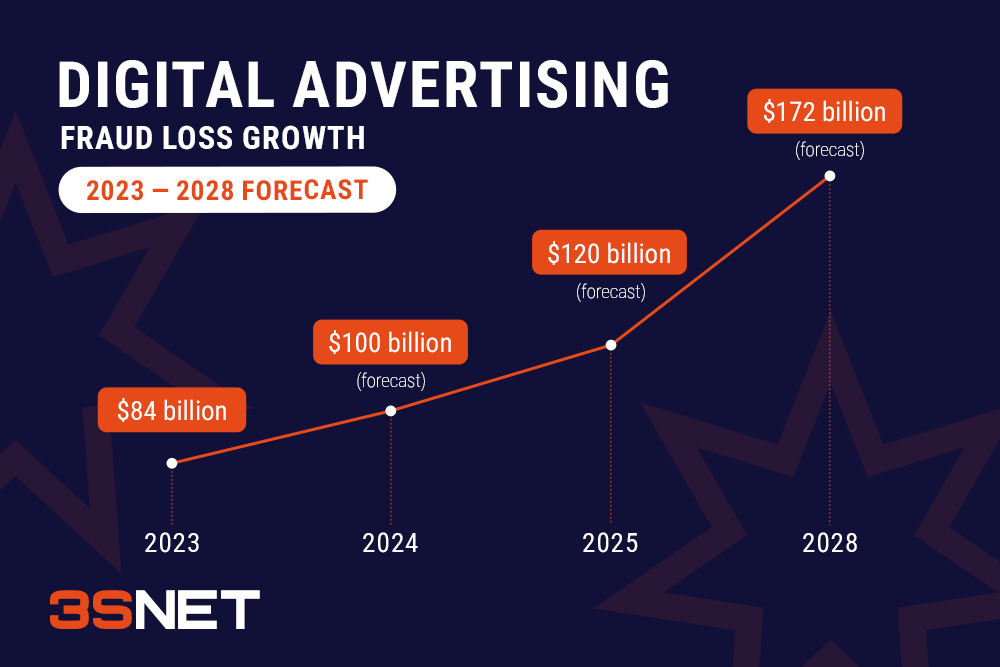

Media buying involves more than just ROI and profit. Moreover, it is about combating fraud, which can consume a substantial part of your budget. According to Juniper Research, global digital advertising fraud losses totaled $84 billion in 2023. That figure is expected to reach $172 billion by 2028. In a new article on 3S.INFO, we’ll analyze the most effective anti-fraud solutions for 2025, designed to safeguard your campaigns and boost profitability.

Scaling isn’t merely about increasing traffic; it represents a strategic approach.

Incorrect scaling, lacking proper analysis and optimization, often results in higher costs without tangible gains. Sustainable long-term growth requires skillful budget management, a well-defined strategy, and reliable analytics. Relying on fraudulent traffic for quick expansion poses risks that eventually culminate in financial losses.

As the graph shows, the problem of ad fraud continues to worsen. Advertisers bear the brunt as they lose their budgets to fake users. Consequently, CPA networks must continually filter traffic, while honest media buyers encounter stricter conditions and checks because of fraudulent activities. Hence, implementing anti-fraud measures and robust analytics has become essential to safeguard the CPA marketing ecosystem.

Why Fraud Remains a Major Problem in Media Buying

Fraud in digital advertising poses a severe menace to the whole sector. Matt Wasserlauf, CEO of Blockboard – a company specializing in video advertising and fraud prevention – asserts that annual fraud losses surpass $20 billion, representing merely the tip of the iceberg.

Each undetected bot or multi-account translates into funds that an advertiser will permanently lose.

In 2023, according to AdGuard, fraud levels in Russia soared to 30%. This means that for every 100 rubles allocated to advertising, advertisers effectively recovered only 70 rubles.

How Do Fraud Schemes Work and How to Detect Them?

Fraud schemes in media buying go beyond simple tricks like clickbait or wrapping. Moreover, they involve sophisticated operations that imitate real user behavior. Nevertheless, advertisers need to understand that when traffic fails to deliver the anticipated ROI, it doesn’t necessarily point to fraud. Issues such as an inefficient sales funnel, improperly configured KPIs, or a poorly crafted offer might be at fault. Before attributing blame to the traffic source, a thorough evaluation of each stage of user interaction is advisable.

Bots have evolved far beyond simply clicking on ads. They can now perform complex tasks such as signing up for accounts, making deposits, and interacting with customer support systems. Below are examples of how these sophisticated schemes operate and ways to detect them:

Bot Traffic: How to Detect and Stop It

- How it works: Bots mimic the behavior of real users, generating clicks, page views, and even conversions. Additionally, they can employ proxies or VPNs to conceal their origin.

- How to detect: Abnormally high CTR with low conversion rates, short sessions on the site, lack of interaction with content (e.g., no scrolling or clicking on page elements).

Multi-Accounting: Signs and Ways to Combat It

- How it works: Users create multiple accounts in order to receive bonuses or repeated conversions. This is especially common in gambling and betting.

- How to detect: Analyzing unique device parameters (fingerprinting), identifying the same IP addresses or devices used to create multiple accounts.

Traffic Spoofing: How to Detect Source Spoofing

- How it works: Fraudsters substitute the source of the traffic, for example, passing off mobile traffic as desktop traffic or vice versa. This is done to get higher payouts for “quality” traffic.

- How to detect: Analyze user data (e.g., screen resolution, device type) and compare it to the claimed traffic source.

Conversion Fraud: How Affiliate Farms Cheat Advertisers

- How it works: Affiliate farms create fake accounts and mimic user actions such as registrations or deposits. This results in payouts for unrealistic conversions.

- How to detect: Analyze user behavior after conversion (e.g., no activity after registration or deposit) and check data for uniqueness (e.g., use of similar email addresses or phone numbers).

Incentivized Traffic: Why It Is Dangerous for Media Buyers

- How it works: Users take an action (such as installing an app) for the sake of a reward, not out of any real interest in the product.

- Why is incentivized traffic a risk?

- Strong advertiser sanctions: If an advertiser detects incentivized traffic, they may not pay for the traffic or even ban the webmaster.

- Tightening conditions in CPA networks: When a network receives complaints from advertisers, it imposes strict restrictions, raises KPIs, or eliminates sources.

- Loss of revenue in the long run: Motivated users do not bring real value – they install the app but do not deposit or purchase. As a result, the advertiser stops working with the offer, and the media buyer loses a revenue stream.

- How to detect: Low user retention, short sessions, lack of repeat actions (e.g., repeat purchases or app usage).

According to a study by The Rock App, 25% of affiliate and programmatic traffic in the iGaming sector was found to be fraudulent. Furthermore, 31% of app installs on iOS and 25% on Android were found to be fraudulent. This highlights that phishing schemes are becoming increasingly sophisticated, especially in high-margin niches such as iGaming.

The Asia-Pacific (APAC) region, which includes countries such as Japan, South Korea, and Australia, is one of the most promising yet challenging markets for the promotion of gambling and betting. According to a study by The Rock App, annual fraud losses in the region reach $75 billion. To be successful in APAC, it is important to understand local idiosyncrasies, regulations, and user preferences.

- Want to learn how to effectively promote gambling and betting in APAC and other regions? Explore our in-depth Market Reviews on 3S.INFO.

| Fraud Type | Characteristics | How to Fight |

| Click Fraud | High CTR (over 10%) with a conversion rate of less than 1%. | Using anti-fraud tools, analyzing IP addresses. |

| Conversion Fraud | Fake registrations, deposits from identical accounts. | KYC checks, delayed payouts. |

| Traffic Spoofing | Mobile traffic is being misrepresented as desktop traffic, distorting analytics. | Analyzing device parameters, use of trackers. |

| Mobile Fraud | SDK Spoofing, incentivized installations. | Connecting anti-fraud solutions, analyzing user behavior. |

| Multi-Accounting | Multiple accounts from one device, bonus abuse. | Fingerprinting, KYC checks. |

How CPA Networks Combat Fraud and Protect Traffic

1. Fingerprinting: Tracks unique device parameters.

2. Delayed payouts: How suspicious conversions are filtered out.

- Learn more about how delayed payouts work in media buying and what a hold is in our 3S.INFO Knowledge Base.

3. KYC checks: User verification to combat multi-accounting.

How to Avoid Fraud: Recommendations from the 3SNET Affiliate Team

Fraud is one of the main causes of budget loss in arbitrage. In our experience, the most common problems faced by advertisers and CPA networks are as follows:

- Lack of anti-fraud tools – even basic analytics systems help to eliminate suspicious traffic.

- Inadequate monitoring of performance over time – spikes in installations without deposit growth, suspiciously low retention rates – are important red flags.

- Insufficient verification of affiliates and sources – it is crucial to understand where traffic originates and which methods affiliates employ.

In particular, when dealing with Dutch traffic, it’s essential to account for the heightened risk of fraud. After the legalization of online gambling in 2021, this market became both highly promising and extremely challenging. The number of toxic players exploiting the CRUKS self-exclusion system has risen significantly. These individuals attempt to manipulate the situation by demanding refunds and threatening legal action after sustaining losses. Consequently, thorough KYC checks and detailed user behavior analyses have become more critical than ever before.

- Want to learn more about the development of online betting and gambling in the Netherlands? Check out our detailed market overview on 3S.INFO.

Metrics for Traffic Analysis and Fraud Detection

| Metric | Definition | Signs of Fraud |

| CTR | Clicks to impressions ratio. | Abnormally high CTR with low conversion rates. |

| CR | Conversions to clicks ratio. | Low CR may indicate irrelevant or fraudulent traffic. |

| EPC | Earnings per click. | A drop in EPC can signal poor traffic quality. |

| ROI | Return on investment. | A sharp drop in ROI may indicate fraud or offer problems. |

| Time on site | Time spent on the site. | Short sessions may indicate bot traffic or incentivized actions. |

How Modern Anti-Fraud Solutions Help Protect Your Budget

Kaminari Click: Real-Time Anti-Fraud Protection

Kaminari Click is a powerful anti-fraud tool that helps block fraudulent traffic before it affects your budget. Here’s how it works:

Device Fingerprinting

- Analysis of unique parameters (browser, OS, IP address) to detect multi-accounts.

Behavior Analysis

- Detection of anomalous patterns (e.g., mass clicks from a single device).

Machine Learning for Identifying New Fraud Schemes

- Automated detection of new fraud schemes.

For example, in Chile, biometric technologies are being introduced to combat fraud. Telecommunications companies are now required to use fingerprints, facial recognition, or electronic signatures to verify users. This helps minimize the risk of fraud, especially in sensitive areas such as online payments and gambling. If you are planning to promote gambling or betting in this region, we recommend that you read 3S.INFO’s report on promotion in Chile. Besides, you can choose from the top offers for Chile.

How to Minimize Fraud Losses: Practical Steps

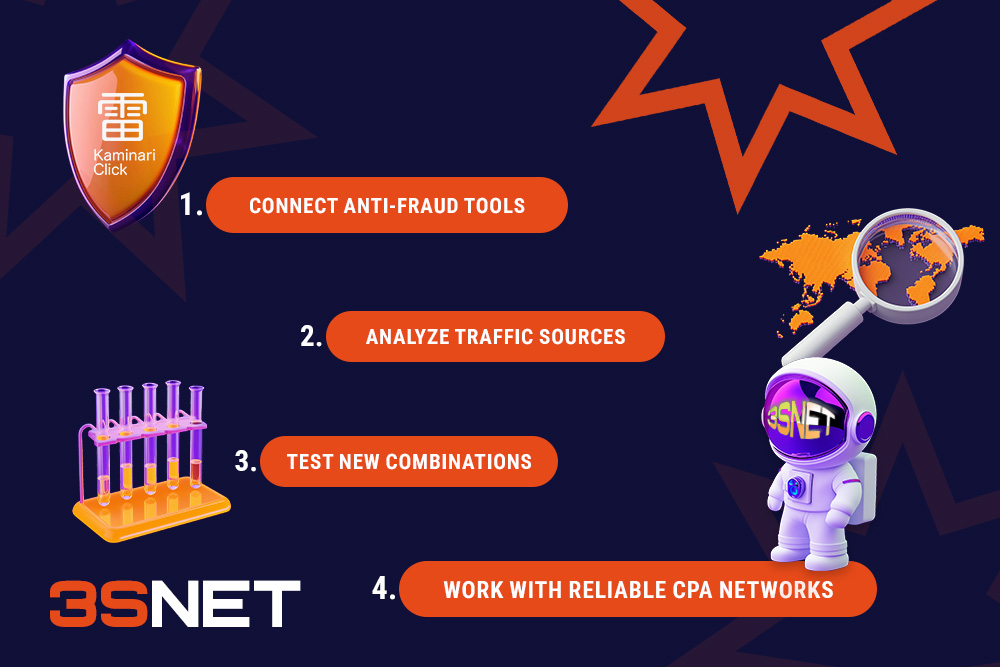

To protect your campaigns from fraud, it’s important to take systematic action. Here’s a step-by-step plan to help you reduce losses and increase ROI:

- Use anti-fraud tools

Advanced solutions allow you to block suspicious traffic in real time. For example, Kaminari Click analyzes user behavior, identifies bots and multi-accounts, and tracks new fraud schemes.

- Analyze traffic sources

It is important for advertisers and CPA networks to regularly check traffic reports and use trackers (Voluum, Binom) for detailed data analysis.

| 3SNET affiliates can use Binom 30 days for free and get -40% for the second month with promo code. |

Pay attention to the following anomalies:

- CTR (Click-Through Rate): Abnormally high CTR (e.g., over 10%) with low conversion (less than 1%) may indicate click fraud.

- Retention Rate: If users install an application but do not return, this may be a sign of incentivized traffic.

- EPC (Earnings Per Click): A sharp drop in EPC often indicates fraudulent or irrelevant traffic.

Test new combinations with minimal risk

- Start with small budgets (e.g., $50-100 per source).

- Use trackers to analyze user behavior.

- Exclude sources with suspicious metrics (e.g., CTR above 15% with CR below 0.5%).

Work with reliable CPA networks

Choose networks that actively combat fraud. For example, 3SNET uses fingerprinting and KYC checks to reject suspicious conversions.

Tip: Before you start, ask your network manager what anti-fraud tools they use and what percentage of fraud they screen out.

Audit your campaigns

- Analyze your CPA network reports once a week.

- Eliminate sources with low ROI or high levels of suspicious activity.

- Use fingerprinting tools to identify multiple accounts and bots.

How CPA Networks Filter Traffic

At 3SNET, we use advanced algorithms to filter out bots, VPNs, and proxies. For example, if a traffic source has an abnormally high CTR but a low conversion rate, it may be a sign of click fraud. You can learn more about our anti-fraud policy on the 3SNET Prohibition of Click Fraud page.

Conversion Analysis

Analytics can help you identify sources with low conversion rates. For example, if traffic from teaser networks has a CR below 1%, you should reconsider the bundle or exclude such sources.

Practical Steps for Minimizing Losses

What do you do when your budget goes to fraud? Here are practical steps to help you minimize losses:

Advice for Gambling and Betting Media Buyers:

- Use tools for analyzing user behavior to identify multiple accounts.

- Test traffic sources with a small budget to minimize risks.

How to Minimize Fraud Losses in Media Buying

Fraud is the challenge that separates successful media buyers from those who waste budgets. Those who implement anti-fraud solutions and analyze every click today will gain a competitive advantage tomorrow. Don’t let fraudsters steal your profits – work with proven CPA networks and analyze every number in your reports.

Want to reduce ad fraud? Try these solutions today:

- Sign up with 3SNET and test the best offers.

- Connect Kaminari Click for fraud protection and get a 15% discount with promo code.

Also read the article from our partner Kaminari Click: How CPA Networks Fight Fraud: The Role of Anti-Fraud Services and Fingerprinting in Traffic Protection.

Share it with your friends via favorite social media